Pakistan Bulletin

Up-to-date and informed analyses of key issues of Pakistan.

Pakistan’s Economy in 2023

July, 2023

Pakistan’s economy is going through its worst crisis. The article takes a look at how the slow growth, rising fiscal deficit, spiraling inflation, growing unemployment and the impacts of the unprecedented 2022 floods, in addition to the political turmoil, have taken a heavy toll on the lives and the livelihoods of common people in 2023. The way out, it is suggested, is political civility, and a strict discipline on macroeconomic policy front.

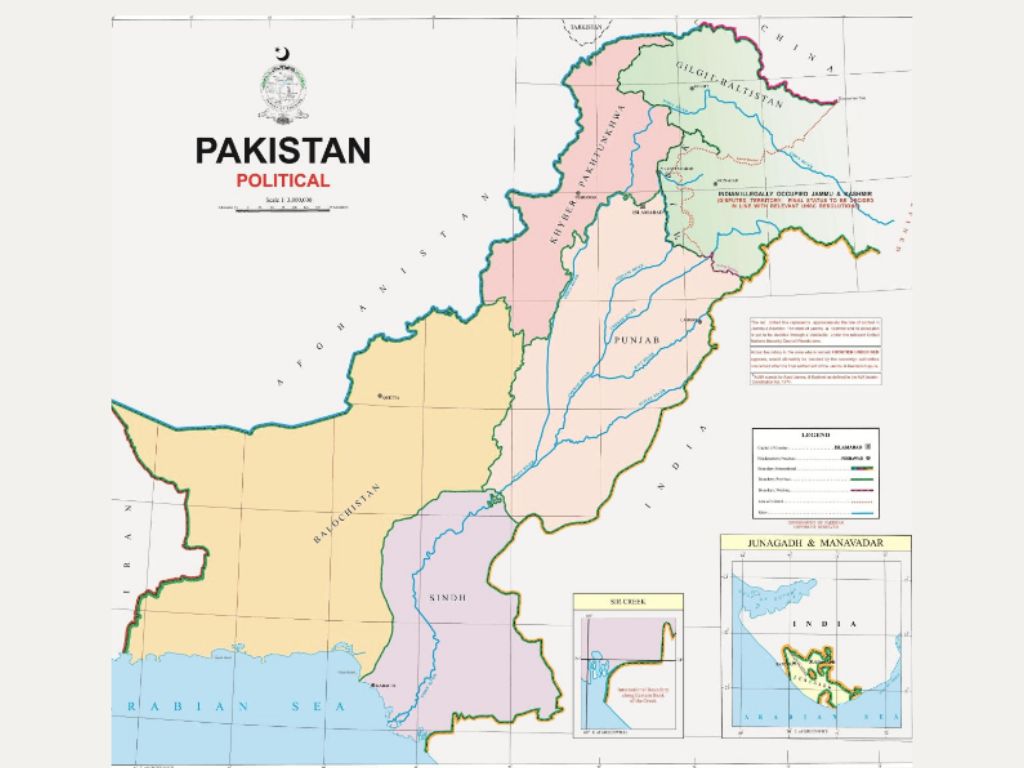

Pakistan experienced two floods in 2022 – a devastating flood in June triggered by the climate change, and an earlier political flood that swept away the government of Imran Khan and installed the current coalition government of Shahbaz Sharif. Both floods damaged the economy immensely and continue to have deteriorating effects on its economic and political landscape. Floods killed over 1700 people, displaced around 8 million, damaged or destroyed 2 million houses, greatly reduced food security, and pushed up food prices. Political floods vastly increased domestic instability, eroded foreign exchange reserves of the country, sent the exchange rate in a tailspin, and raised the consumer price inflation to over 30 percent.

Because of both floods, real GDP growth which was recorded at 6.0 percent in FY22 is now projected to collapse to only 0.8 percent in FY23 according to the Ministry of Finance. Other independent estimates put it around zero or negative. Inflation that averaged 12.2 percent in FY22 is now projected to go around 30 percent in FY23. The unemployment rate is expected to go up significantly as industrial activities have already declined. Large-scale manufacturing industries (LSMI) output has declined by 25 percent in March 2023 over twelve months. Small-scale manufacturing units have considerable linkages with LSMI and, therefore, their activities have also gone down.

Pakistan is passing through its worse economic and political crises in its history. Its economic past is characterized by boom-and-bust cycles of growth. FY22 growth was induced by both monetary and fiscal stimuli. Government expenditure was 19.9 percent of GDP whereas its revenue was only 12 percent of GDP. The gap between them, or the fiscal deficit was 7.9 percent of GDP. The gap was financed by a huge borrowing, both internal and external, in FY22. These borrowing stimuli increased the demand for both domestic and imported consumption and the growth was mostly consumption-driven as the consumption to GDP ratio was a staggering 99.6 percent. The gap between imports of goods and services ($84.1 billion) and exports of goods and services ($39.4 billion) became $44.7 billion, which was filled with remittances of $32.5 billion leaving a deficit in the current account of $17.4 billion.

There is no reason that the country cannot come out of this economic and political crisis. All that is needed is political civility, and a strict discipline on macroeconomic policy front.

Accumulated internal and external borrowings took the outstanding level of total debt and liabilities to 89.3 percent of GDP in FY22 from 85.8 percent of GDP a year earlier. Debt servicing on external debt increased to $15.1 billion and the budgetary impact of interest payments on both external and internal debt came close to 40 percent of total revenue. Pakistan is now borrowing to also meet its interest and principal payments, which together with thin foreign exchange reserves of only $4.4 billon (in the first week of May 2023) is increasing the risks of default. A good thing is that the balance of payments is rapidly adjusting. The current account deficit during July-April FY23 has been reduced to $3.3 billion from $13.7 billion compared with the same period of the previous year. However, the budget deficit has not shown any improvement during July-March FY23 over July-March FY22.

On the verge of default, Pakistan secured a tentative $3 bn funding deal on 30 June 2023 with the IMF. Pakistan will also need a medium-term facility from IMF to put the country on a credible path of macroeconomic adjustment. It also needs to restore its political stability by holding free and fair elections in the country very soon as credible economic policies require a credible political setup. Current political confrontations in Pakistan prompted a friendly advice from China’s Foreign Minister: “We sincerely hope the political forces in Pakistan will build consensus, uphold stability and more effectively address domestic and external challenges so it can focus on growing the economy.” Earlier in February 2023 a sound economic advice came from Kristalina Georgieva, IMF Chief who chided Pakistan to do two things: taxing the rich and moving subsidies only to poor. She summed up the fiscal problems in Pakistan in a few sentences while talking to German Media DW-Asia.

Current stagflation with collapsing growth and record high inflation in Pakistan has pushed millions of people into poverty. Unlike the macroeconomic statistics, which are available with a lag of one or a few months, socioeconomic data in Pakistan including the unemployment rate become available with a lag of a couple of years. However, with high inflation and growth stagnation it is obvious in which direction poverty, unemployment and living conditions are moving. Pakistan had shown a commendable reduction in its poverty headcount ratio between FY11 and FY22 according to the World Bank. International poverty rate ($2.15 a day in 2017 purchasing power prices) was reduced from 9.4 percent in FY11 to an estimated 3.9 percent in FY22. Lower-middle income poverty rate ($3.65 a day in 2017 PPP) went down from 52.4 percent in FY11 to 36.4 percent in FY22. New comparable FY23 poverty rates, when available, would show a few percentage point increases in poverty according to both definitions.

The daily wage of a labourer was $3.79 in the first week of May 2023. Compare this with an average price of $ 9.83 for a wheat flour bag of 20kg in the same week, and you can visualize the hardship of daily-wage labourers without actual data about the incidence of current poverty in Pakistan.

What is the impact of current economic conditions on poor and low-income households of Pakistan? People feel helpless, and pessimistic. These actual feelings cannot be captured by current data except for the weekly wage data of labourers, and inflation in terms of the Sensitive Price Indicator (SPI), which is a small subset of CPI basket comprising food and essential non-food items, capturing the consumption profile of low-income households. SPI inflation is available on a weekly basis and has been running between 40 and 50 percent for the past several weeks. The daily wage of a labourer was $3.79 (Rs1,048) in the first week of May 2023 according to the Pakistan Bureau of Statistics (PBS). Compare this with an average price of $ 9.83 (Rs2,720) for a wheat flour bag of 20kg in the same week, and you can visualize the hardship of daily-wage labourers without actual data about the incidence of current poverty in Pakistan.

Despite all this misery there is no reason that the country cannot come out of this economic and political crisis. All that is needed is political civility, and a strict discipline on macroeconomic policy front. Some discipline is already visible on the current account of the balance of payments, which cannot by itself translate into fiscal discipline, and which is urgently needed to put Pakistan on a trajectory of sustainable growth and development.

Riaz Riazuddin

Author

Riaz Riazuddin is Former Deputy Governor of State Bank of Pakistan. He holds M.A.S Economics form

Applied Economics Research Centre, University of Karachi.

Get the latest news and updates from our team

- YOU MIGHT ALSO LIKE